Today,

we have a loan for just about everything, be it a house, car, foreign trip and

even a mobile.

The 'loan culture' has caught on in a big way. A majority of people

have availed of loans at some point or the other.

But do we really know how the EMI on the loan

is calculated?

What is an EMI?

An EMI is a

monthly amount paid by the borrower to the lender in order to clear the

outstanding loan amount. A specific sum of pre-decided amount is deducted from

your chosen account, every month without fail. The deduction is not affected by

any sudden financial constraints you may face and will continue to be carried

out by the bank. The EMIs are usually deducted on a fixed date every month

until the tenure of the loan is completed and the whole loan amount is repaid

An Equated Monthly Installment (EMI) is the amount paid by a borrower

each month to a lender of the loan.

The EMI is an unequal combination

of principal (the actual loan you have

taken) and interest rate.

EMI payments are made every month, generally on a fixed date, for

the entire tenure of the loan, till the outstanding amount, has been completely

repaid.

It is important to understand how

banks work out the EMI so that you would find it easier to evaluate various

loan options.

So

how does the bank arrive at the future value of a loan & interest to be

repaid at future dates?

The answer is ‘Time value of money’. The theory of time value of money says that a

rupee receivable today is more valuable than a rupee receivable at a future

date. This is because the rupee received today can be invested to earn

interest. For instance: Rs. 100 receivable today can be invested at, say, 9%

interest and therefore

enables one to earn an additional Rs. 9 in a year.

In

the earlier years of loan repayment, it is mainly the interest payments that

are being made while the principal amount is much less. As

the loan matures, and as the principal gradually gets paid, the outstanding

loan amount reduces. The interest component thus becomes lower than the

principal, and finally minimal.

PAYMENT OPTIONS

FIXED RATE EMI: Fixed rate loans are those which remain the same throughout

the tenure. This can be the best option only when the interest rate has reached the bottom, from where an upward trend is expected.

FLOATING RATE EMI: Floating rates move in tandem with market and RBI

measures which are prone to fluctuation depending on the market and economy.

Does

my EMI stays constant?

Yes.

Though the EMI is an unequal combination of interest rate and principal, it

stays constant. Unless…

Unless:

If you prepay part of the loan, the amount of your remaining EMIs

will not remain the same if you leave the duration of your loan constant.

In case you have taken a floating rate loan, the EMI will change

as the interest rates change. Of course, some have the option of the EMI not

changing but the tenure increasing or decreasing.

You opt for a loan where the EMI keeps increasing over the years.

To give an example, let's say you have a 10-year loan. The EMI stays constant

for three years, then rises for the next three years and rises again for the

last four years. This will help young individuals who cannot afford a huge EMI

at this point but can do so as their earnings rise.

Mathematics Calculation of EMI:

EMIs

for a home loan are calculated using the following mathematical formula:

EMI

= P x r x (1+r) n/((1+r)n-1)

Where,

P = Loan amount

r

= Rate of interest

n

= Loan Tenure (number of months)

The various methods adopted are:

Annual reducing method: A method of calculating interest on the reduced

principal at the end of every year. However, as repayments for all loans are

EMI, though the principal is reduced every month, the interest is calculated on

the original loan amount for twelve months after which the repayments towards a principal is taken into account. Basically, this method will benefit you the

least.

METHOD OF COMPUTATION

Monthly reducing loans: This is a better and easy to understand the method of EMI calculation and is usually the most common calculation method

adopted. In this calculation methodology, there is a reduction in principal with

EMI being paid every month. The interest is calculated on the outstanding

balance.

Daily reducing loans: In this method, the principal reduces every

day, with daily loan repayments. The interest is charged on the outstanding

balance. However, daily EMI payment is not a very feasible option.

PRE-EMI

AND ADVANCE DISBURSEMENTS (Relevant in case of a home loan)

There

are instances where the borrower may opt for a partial disbursement of their

home loan on the basis of the stages of construction of

their house. In such cases, a pre-EMI is to be paid every month until the final

loan is disbursed. The real loan repayment would commence only after the entire a loan is disbursed. This pre-EMI would, therefore, comprise only the interest

accrued on the disbursed money.

Also,

there are cases when the entire loan may be disbursed by lenders before the

completion of house construction. This is known as an advance disbursement and

is undertaken by the lender when it is requested by the borrower

and the lender is convinced of the capabilities of the builder to complete the

construction work in time. In these cases, the EMI payment starts immediately

from the date of disbursement.

The benefit of an EMI for borrowers

is that they know precisely how much money they will need to pay toward their

loan each month, making the personal

budgeting process easier.

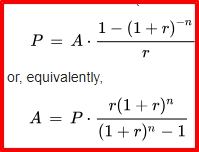

The formula for EMI (in arrears) is

where: P is the

principal amount borrowed, A is the periodic amortization payment, r is the periodic interest

rate divided by 100 (annual interest rate also divided by 12 in case of monthly

installments), and n is the total number of payments (for a

30-year loan with monthly payments n = 30 × 12 = 360).

For example, if you borrow 10,000,000

units of a currency from the bank at 10.5% annual interest for a period of 10

years (i.e., 120 months), then EMI = Units of currency 10,000,000 * 0.00875 *

(1 + 0.00875)^120 / ((1 + 0.00875)^120 – 1) = Units of currency 134,935. i.e.,

you will have to pay total currency units 134,935 for 120 months to repay the

entire loan amount. The total amount payable will be 134,935 * 120 = 16,192,200

currency units that includes currency units 6,192,200 as interest toward the

loan.

Example

Flat Method

|

| Flat Method |

|

| Flat Method |

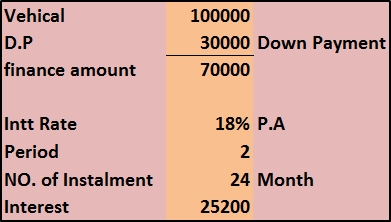

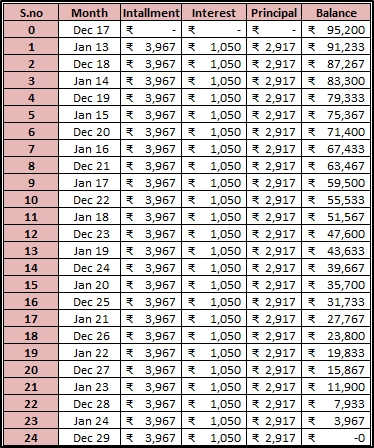

2) REDUCING METHOD

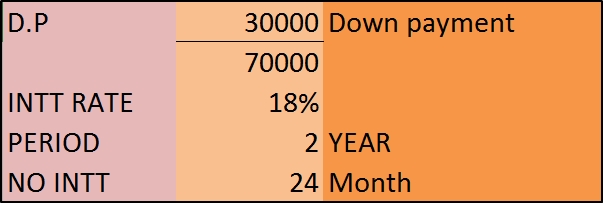

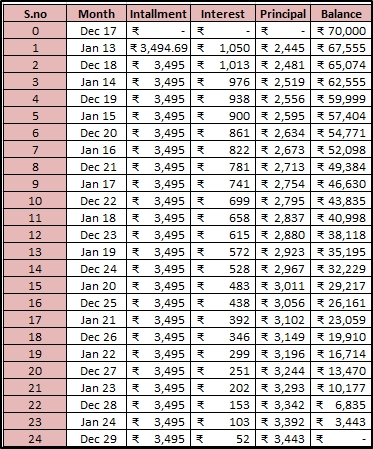

A) Installment = -PMT(Interest Rate/12,No.of.Installment,Finance Amount)

B)Principal = -PPMT(Interest Rate/12,Serial No,No.of.Installment,Finance Amount)

C)Interest = -IPMT(Interest Rate/12,Serial No,No.of.Installment,Finance Amount)

Above Formula Can use in M.S.Excel

0 Comments