|

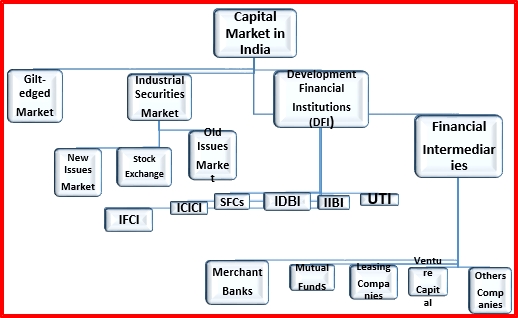

| Capital Market in India |

Market

for Government and semi-government securities, which carry fixed interest rates

and backed by RBI. The securities traded in this market are stable in value

and are much sought after by banks and other institutions.

The industrial securities market is the market for equities and debentures

of companies in the corporate sector. This market further classified into

(a)

New Issues Markets; for raising fresh capital in the form of shares and

debentures, and

(b)

Old Issues Market; for buying and selling shares and debentures of existing

companies–this market is commonly known as the stock market or stock exchange.

Both markets are equally important, but often the new issues market will be

facilitated only when there are abundant facilities for transfer of existing

securities. The capital market is also classified into Primary Capital Market

and Secondary Capital Market

The

primary capital market refers to the new issues market, which relates to

the issue of shares, preference shares and debentures of non-government public

limited companies, and also to the raising of fresh capital by Government

companies, and also to the raising of

fresh

capital by Government companies and the issue of public sector bonds.

The

secondary capital market, on the other hand, is the market for old or

already issued securities. It is composed of Industry Security Market or the stock exchange in where industrial securities are bought and sold, and the

Gilt-edged Market where the government and semi-government, securities are

traded.

Recommended for you Market Segmentation

Recommended for you Market Segmentation

A Development Finance Institution (DFI)

or Development Bank or Development Finance Company (DFC)

is a financial institution that provides risk capital for economic

development projects. They are often established by governments or charitable

institutions to provide funds to projects that would otherwise not be able to

get funds from commercial lenders. Some development banks include socially

responsible investing and impact investing criteria into their

mandates. Governments often use development banks to form part of their development

aid.

DFIs

can include multilateral development banks, bilateral development

banks, microfinance institutions, community development financial

institution and revolving loan funds

Mumbai Inter-Bank Offer Rate (MIBOR)

Mumbai Inter-Bank Bid Rate (MIBID)

MIBOR

and MIBID

On

June 15, 1998, the National Stock Exchange launched two new Reference Rates for the loans

of Inter-Bank Call Money Market. These rates are Mumbai Inter-Bank Offer Rate (MIBOR)

and Mumbai Inter-Bank Bid Rate (MIBID). MIBOR will be the indicator of Landing The rate for loans which MIBID will be the landing rate of receipts.

Share

Market

India has a well

developed a share market system, which is one of the best in the developing world.

It has one of the oldest stock markets in Asia. The first stock exchange was

established in 1875 in Bombay (Mumbai), when the stockbrokers against at their

plight following the severe depression insecurities decided to form an

association to protect the character and interest of native share and stock

brokers.

Primary

Market

The

primary market refers to the set up by which the industry raises funds by

issuing different types of securities. These securities are issued directly to

the investors, both individual and institutions. The primary market discharges

the important function of transfer of savings, especially of the individual,

Government and public sector undertakings. In the primary market, the new

issues of securities are presented in the form of Public issues, Right issues, and Private Placements. Its efficient operation is made possible by the financial

intermediaries and financial institutions, who arrange long-term financial transactions

for the clients. Issues of the securities in the primary market may be made through

(i) Prospectus, (ii) Offer for sale, and (iii)

Private Placement. The securities offered to the public through prospectus are

directly subscribed by the investor. The issuing companies widely publicize the

offer through various media. The Securities Exchange Board of India (SEBI) has

classified various issues in three groups i.e., New issues, Right issues, and Preferential issues. The SEBI has issued various guidelines regarding proper

disclosure for investor’s protection. These guidelines are required to be duly

observed by the companies making an issue of capital. The guidelines issued by the

SEBI broadly cover the requirements regarding the issue of capital by the companies.

The guidelines are applicable to all the companies after the repeal of

Controller of Capital Issues (CCI ) Act 1947.

0 Comments