The term ‘Capital budgeting’ means planning for capital assets. It refers to the process of making investment decisions capital expenditures setting factory or installing machinery or creating additional capacities to manufacture a part which at present may be purchased from outside.

The words capital refer to the total investment of company firms in money, tangible and intangible assets.

it may be said to be the art of building budgets. Budgets are a blueprint of a plan and action expressed in quantities and manners.

Examples of capital expenditure:

1. Purchase of fixed assets such as land and building, plant and machinery, goodwill, etc.

2. The expenditure relating to addition, expansion, improvement, and alteration to the fixed assets.

3. The replacement of fixed assets.

4. Research and development project.

Definitions

According to the definition of Charles T. Hrongreen, “capital budgeting is long-term planning for making and financing proposed capital outlays.

Objectives of Capital Budgeting

1)Control on Expenditures

2)Performance Review

3)Evaluation of Long-Term Capital Expenditures

4)Comparison Between Various Investment Proposals

5)Forecasting Futures Needs of Cash

Need and Importance of Capital Budgeting

1. Huge investments: Capital budgeting requires huge investments of funds, but the available funds are limited, therefore the firm before investing projects, the plan is controlled its capital expenditure.

2. Long-term: Capital expenditure is long-term in nature or permanent in nature. Therefore financial risks involved in the investment decision are more. If higher risks are involved, it needs careful planning of capital budgeting.

3. Irreversible: The capital investment decisions are irreversible, are not changed back. Once the decision is taken for purchasing a permanent asset, it is very difficult to dispose of those assets without involving huge losses.

4. Long-term effect: Capital budgeting not only reduces the cost but also increases the revenue in the long-term and will bring significant changes in the profit of the company by avoiding over or more investment or underinvestment. Over investments leads to be unable to utilize assets or overutilization of fixed assets.

Therefore before making the investment, it is required careful planning and analysis of the project thoroughly.

Capital Budgeting Process

|

Capital Budgeting Process

|

Identification of various investments proposals: The capital budgeting may have various investment proposals. The proposal for the investment opportunities may be defined from the top management or maybe even from the lower rank. The heads of various investments analysis that decision should be to take by that committee

Screening or matching the proposals: The planning committee will analyze the various proposals and screenings. Select that proposal that helps to get available resources and that help to the committee to take a decision

Evaluation: After Screening or matching the proposals Evaluation such as payback period proposal, net discovered present value method, accounting rate of return and risk analysis. Each method of evaluation used in detail

(a) Independent proposals

(b) Contingent of dependent proposals

(c) Partially exclusive proposals.

Independent proposals are not compared with another proposal and the same may be accepted or rejected. Whereas higher proposals acceptance depends upon the other one or more proposals.

Fixing property: After evaluation Planning committee will take a decision which proposals give more profit and that impact fixing property help to take a decision. If the projects or proposals are not suitable for the concern’s financial condition, the projects are rejected without considering other nature of the proposals.

Final approval: The planning committee takes the final step on that first Profitability, Economic constituents, Financial violability, Market conditions. that all things should take in mind by the planning committee

Implementing: The competent authority takes decision sand to spend money, implementing that proposals, means that approval decision converted into the implement It helps the management for monitoring and containing the implementation of the proposals.

Performance review of feedback: The final stage of capital budgeting is actual results compared with the standard results. The adverse or unfavorable results identified and removing the various difficulties of the project

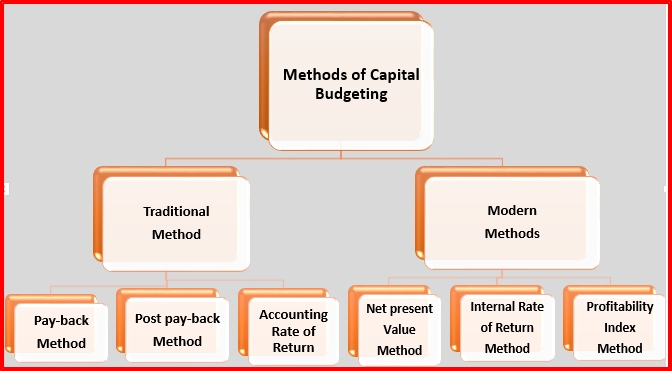

METHODS OF CAPITAL BUDGETING OF EVALUATION

The methods of evaluations are classified as follows:

(A) Traditional methods (or Non-discount methods)

(i) Pay-back Period Methods

(ii) Post-Pay-back Methods

(iii) Accounts Rate of Return

(B) Modern methods (or Discount methods)

(i) Net Present Value Method

(ii) Internal Rate of Return Method

(iii) Profitability Index Method

Pay-back Period

Pay-back period is the time required to recover the initial investment in a project.

(It is one of the non-discounted cash flow methods of capital budgeting).

Pay-back period = Initial investment / Annual cash inflows

Post-Pay-back Profitability Method

One of the major limitations of the payback period method is that it does not consider the cash inflows earned after the pay-back period and if the real profitability of the project cannot be assessed. To improve this method, it can be made by considering the receivable after the pay-back period. These returns are called post pay-back profits.

Accounting Rate of Return or Average Rate of Return

An average rate of return means the average rate of return or profit taken for considering the project evaluation. This method is one of the traditional methods for evaluating the project proposals:

Net Present Value

Net present value method is one of the modern methods for evaluating the project proposals. In this method, cash inflows are considered with the time value of the money. Net present value describes as the summation of the present value of cash inflow and the present value of

cash outflow.

Internal Rate of Return

An internal rate of return is time adjusted technique and covers the disadvantages of the traditional techniques. In other words, it is a rate at which discount cash flows to zero.

It is expected by the following ratio:

Cash inflow / Investment initial

Steps to be followed:

Step1. find out factor

A factor is calculated as follows:

F= Cash outlay (or) initial investment / Cash inflow

Step 2. Find out positive net present value

Step 3. Find out negative net present value

Step 4. Find out formula net present value

Formula

IRR =Base factor + Positive net present value / Difference in positive and Negative net present value x dp

Base factor = Positive discount rate

DP = Difference in percentage

0 Comments