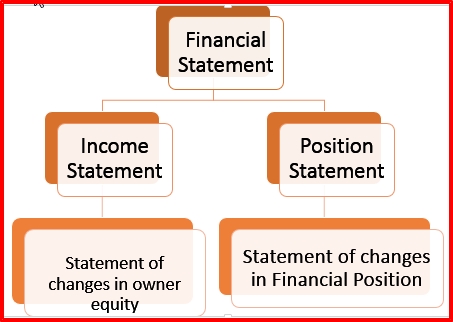

The financial statement means a summarized statement of accounting data produced at the end of the accounting process by an enterprise through which it communicates accounting information to the external uses. The external users can be investors, lenders, suppliers and trade creditors, Customers, government and their agencies, the public at large and employees customarily, a set of financial statements include:

· A Balance sheet

· A profit and loss account, and

· Schedules and notes forming part of the balance sheet and profit and loss account.

Meaning and Concept of Financial Analysis

The term ‘Financial Statement’ which is also known as analysis and interpretation of financial statement refers the process of determining financial strengths and weaknesses of the firm by stabilizing the relationship between the items of the balance sheet.

The financial analysis means a study of various factors that can be not effecting on future profits that finding is an essential analysis of various ways that can be changed according to the situation,

A financial statement analyst analysis the financial statement with various tools of analysis before commenting upon the financial health or weakness of an enterprise just like Doctor who examines his patients by recording his body temperature, blood pressure, etc.

|

Income Statement

Income statement means profit and loss account that shows that It determines the entire operational performance of the concern like total revenue generated and expenses incurred for earning that revenue.

Income statement show Income statement helps to ascertain the gross profit and net profit of the concern. Gross profit is determined by preparation of trading or manufacturing a/c and net profit is determined by the preparation of profit and loss account.

Position Statement

Position statement means Balance sheet of it reflects that the financial position of the firms at the end of financial years

Position statement shows that total Assets, liability, and position of that firms it strong or weakness that help in the development of firms

Statement of Changes in Owner’s Equity

It is also called a statement of retained earnings. This statement provides information about the changes or position of owner’s equity in the company. How the retained earnings are employed in the business concern. Nowadays, preparation of this statement is not popular and nobody is going to prepare the separate statement of changes in owner’s equity.

Statement of Changes in Financial Position

Income Statement and position statement that helps to take a decision of what we do about to change the financial position of a firm. Income statement and position statement shows only about the position of the finance, hence it can’t measure the actual position of the financial statement. Statement of changes in financial position helps to understand the changes in financial position from one period to another period.

Types of Financial Analysis

|

| Types of Financial Analysis |

1)On the basis of material used- Under this category financial analysis

A) External Analysis- This analysis is done by an outsider who has no access to the internal records of the business firm. This outsider includes potential investors, Creditors, Government agencies, Credits agencies, and the general public.

B) Internal Analysis This analysis is done by an accountant that analysis of statement or book of account that is related to the business handled by the accountant. Therefore such analysis can be performed organization employees government agencies have statutory powers vested in them.

2) On the basis of the firm involved

A) Infra-Firm analysis It is a comparison of financial variables of a business enterprise over a period of time that analysis of performance and of business

B) Inter-Firms Analysis It is a comparison of two or more business enterprises. Two statement comparison each other that is an analysis it is cross-section analysis.

3) On the basis of modus operandi

A) Horizontal Analysis When the financial statements relating to different years are compared and reviewed it is known as horizontal analysis. For the types of analysis, the figures are presented horizontally over a number of columns. The figures of various years compared with standard or base year.

B) Vertical Analysis vertical analysis refers to the study of the relationship of the various items in the financial statements of one accounting period. The ratios of different items of costs for a particular period may be calculated with the sates for that period. Such an analysis is useful in comparing the performance of several companies in the same group or divisions in the same company.

Tools or Techniques of financial statement analysis

1)Trend Percentages

2)Funds Flow Statement

3)Common – size financial statement

4)Cash Flow Statement

5)Comparative Financial Statements

6)Ratio Analysis

Objectives, Advantages, and Uses of Ratio Analysis

1)Useful in simplifying accounting-figures

2)Useful in Inter-firm and Internet-firms comparison

3)Useful in the analysis of financial statements

4)Useful for forecasting purpose

5)Useful in locating the weak spots of the business

6)Useful in judging the operating efficiency of the business.

Limitation of Ratio Analysis

1)Not comparable if different firms follow differently

2)Affect of price level changes

3)ignores qualitative factors

4)Different meanings are put on different terms

5)A result may be misleading in the absence of absolute

6)False Result

7)Personal bias

8)Window dressing

9)Difficult to forecast the future on the basis of past facts

Click on a link below to Read interesting topic English and Hindi

· नीचे दिए गए लिंक पर क्लिक करें पढ़ें दिलचस्प विषय अंग्रेजी और हिंदी

· | गोल्डन रूल्स ऑफ अकाउंटेंसी | लेखांकन के बेसिक नियम

· What is GST in India? Goods & Services Tax Law Explained

· भारत में GST क्या है? माल और सेवा कर कानून समझाया

· What is Gratuity How to calculate? Is Income Tax Exempted on Gratuity?

· ग्रेच्युटी क्या है? गणना कैसे करें? क्या ग्रेच्युटी पर आयकर छूट है?

3 Comments

Nice article,We provide many forms of ongoing financial education including seminars, webinars, monthly newsletters and self-help guides – all with the aim of helping you make the well informed financial decisions you deserve. Interested in attending one of our scheduled events please click here. We also provide access to a global network of independent financial advisers around the world.Financial Analysis

ReplyDeleteDearest Esteems,

ReplyDeleteWe are Offering best Global Financial Service rendered to the general public with maximum satisfaction,maximum risk free. Do not miss this opportunity. Join the most trusted financial institution and secure a legitimate financial empowerment to add meaning to your life/business.

Contact Dr. James Eric Firm via

Email: fastloanoffer34@gmail.com

Best Regards,

Dr. James Eric.

Executive Investment

Consultant./Mediator/Facilitator

We deliver best outsourcing accounting agency with the accurate work of bank statement work, general journal, cash flow statement, balance sheet work and depreciation accounting.

ReplyDelete